kansas sales tax exempt form agriculture

Are exempt from sales tax. However there are four sales and use tax exemptions specifically for agribusiness.

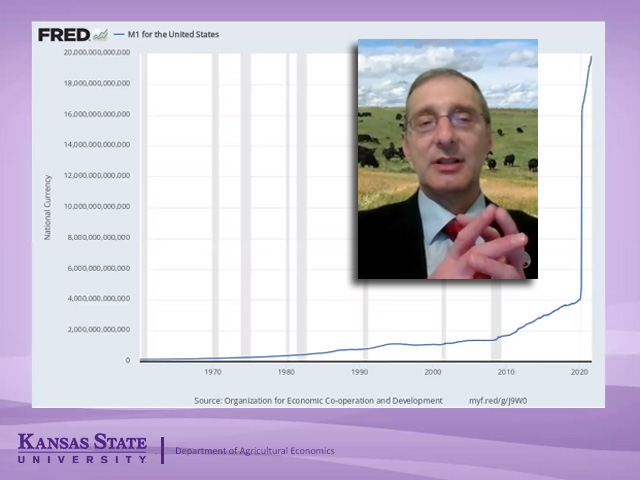

Pro And Con Tax Provisions In The Build Back Better Act

Kansas taxes apply to your agricultural business.

. Ingredient or component part Consumed in production Propane for agricultural use The. For corporations whose business income is solely within state boundaries the tax is 4 of net income. In addition net income in excess of 50000 is subject to a 3.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. In addition net income in excess of 50000 is subject to a 3. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment.

Online Applications and Renewals. KDA HQ Emergency Evacuation Plan. Ingredient or component part Consumed in production Propane for agricultural use The.

Agriculture sales tax exemption. For tax exemption status. Sales Tax Account Number Format.

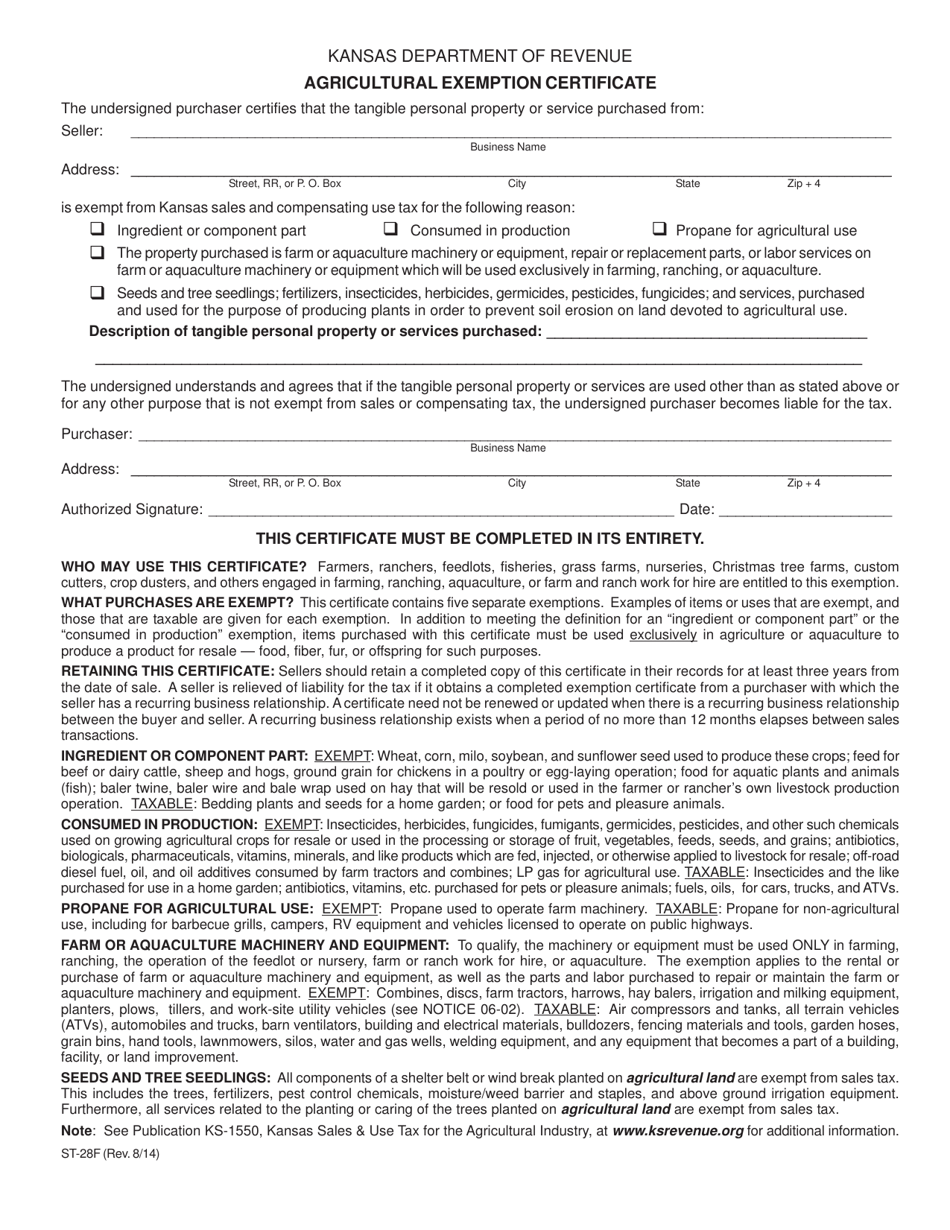

Any sales tax-exempt entity that does not have an exemption certificate may apply online at the Kansas Department of Revenues website. Most large animal small animal and brand applications can be submitted online through Kelly Solutions by clicking here. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from.

Is exempt from Kansas sales and compensating use tax for the following reason check one box. For corporations whose business income is solely within state boundaries the tax is 4 of net income. ARKANSAS COMMERCIAL FARMING MACHINERY EQUIPMENT SALES TAX EXEMPTION CERTIFICATE Form ST-403 Arkansas state code allows for an.

Homeland Security TrainingIS 700. Is exempt from Kansas sales and compensating use tax for the following reason check one box. These are the tax exemptions for.

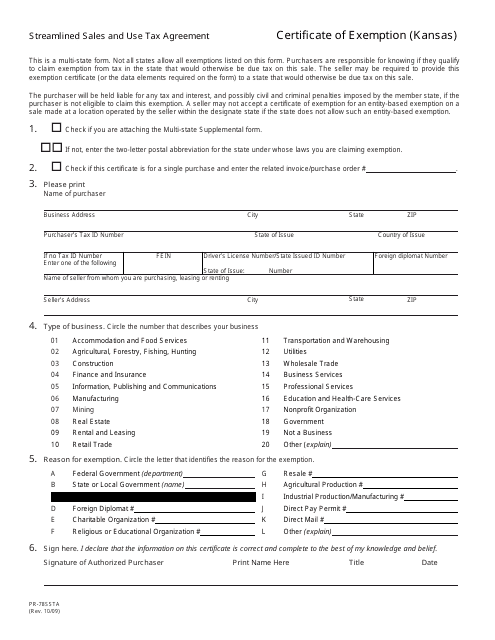

Your Kansas sales tax account number has three distinct parts. How to use sales tax exemption certificates in Kansas. Complete the Streamlined Sales Tax Agriculture Exemption Certificate before making your agricultural related purchases with KanEquip.

Payments may be made via credit. Farmers per se are not exempt from Kansas sales or use tax. Do Kansas resale exemption certificates expire.

Using common industry examples it explains which items are taxable which are exempt and how to properly claim the exemptions. This page discusses various sales tax exemptions in Kansas. Order for the sale to be exempt.

One of Oklahoma Farm Bureaus very first policy priorities in 1942 the state sales tax exemption on agricultural inputs is a crucial. While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation.

Get And Sign Who Fills Out Kansas Department Of Revenue For Pr 74a Form 2005 2022

Form Pr 78ssta Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption Kansas Kansas Templateroller

Tangible Personal Property State Tangible Personal Property Taxes

Kansas Taxes Credits And Exemptions Kansas Department Of Commerce

Kansas Income Tax Returns Things To Know Credit Karma

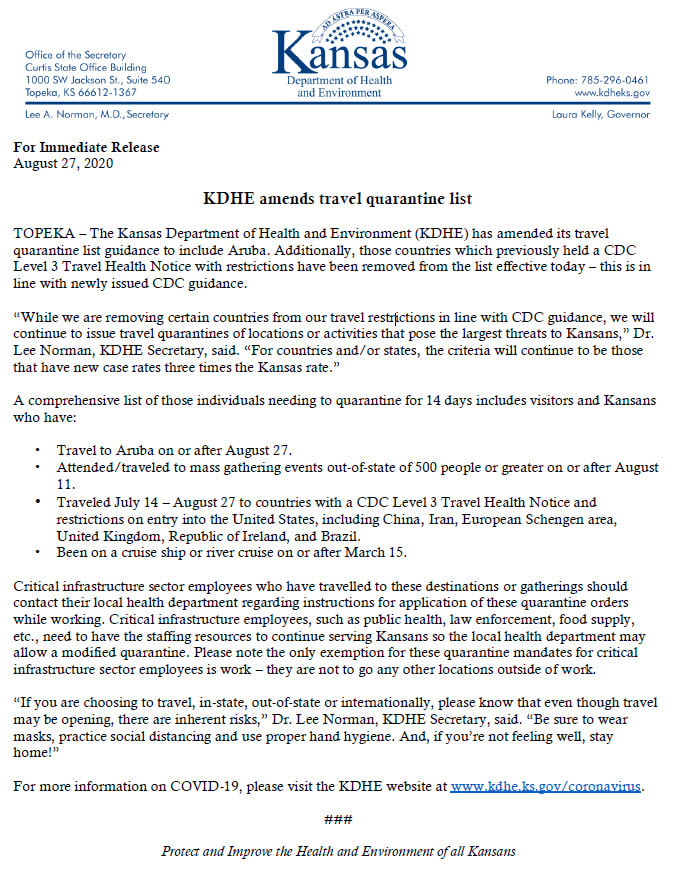

Archived Press Releases Crawford County Ks

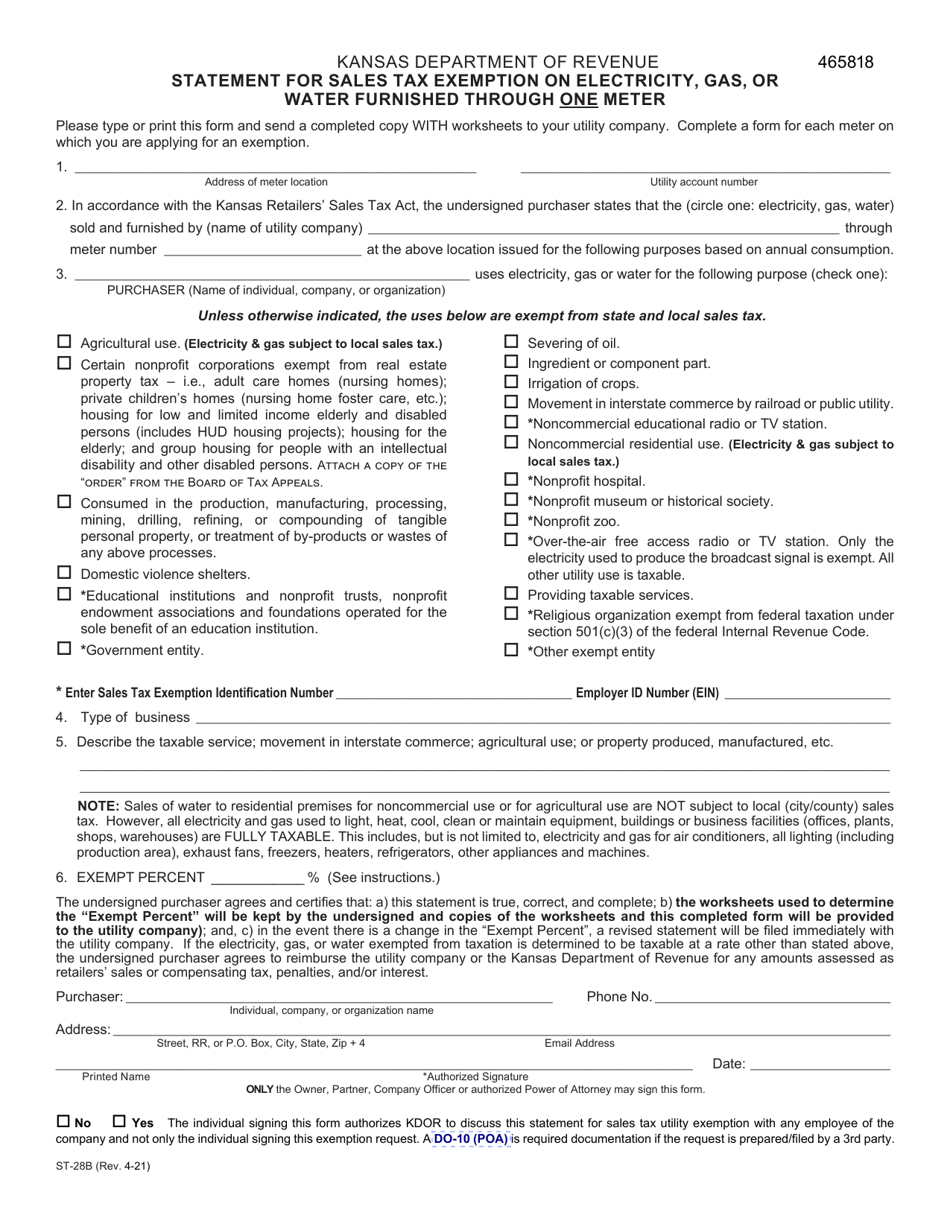

Form St 28b Download Fillable Pdf Or Fill Online Statement For Sales Tax Exemption On Electricity Gas Or Water Furnished Through One Meter Kansas Templateroller

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Form St 28f Download Fillable Pdf Or Fill Online Agricultural Exemption Certificate Kansas Templateroller

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How To File And Pay Sales Tax In Kansas Taxvalet

2022 State Tax Reform State Tax Relief Rebate Checks

Kansas Sales Tax Guide For Businesses

State Tax Revenue Tops February Estimate Kelly Calls For Food Sales Tax Exemption Kansas Reflector

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

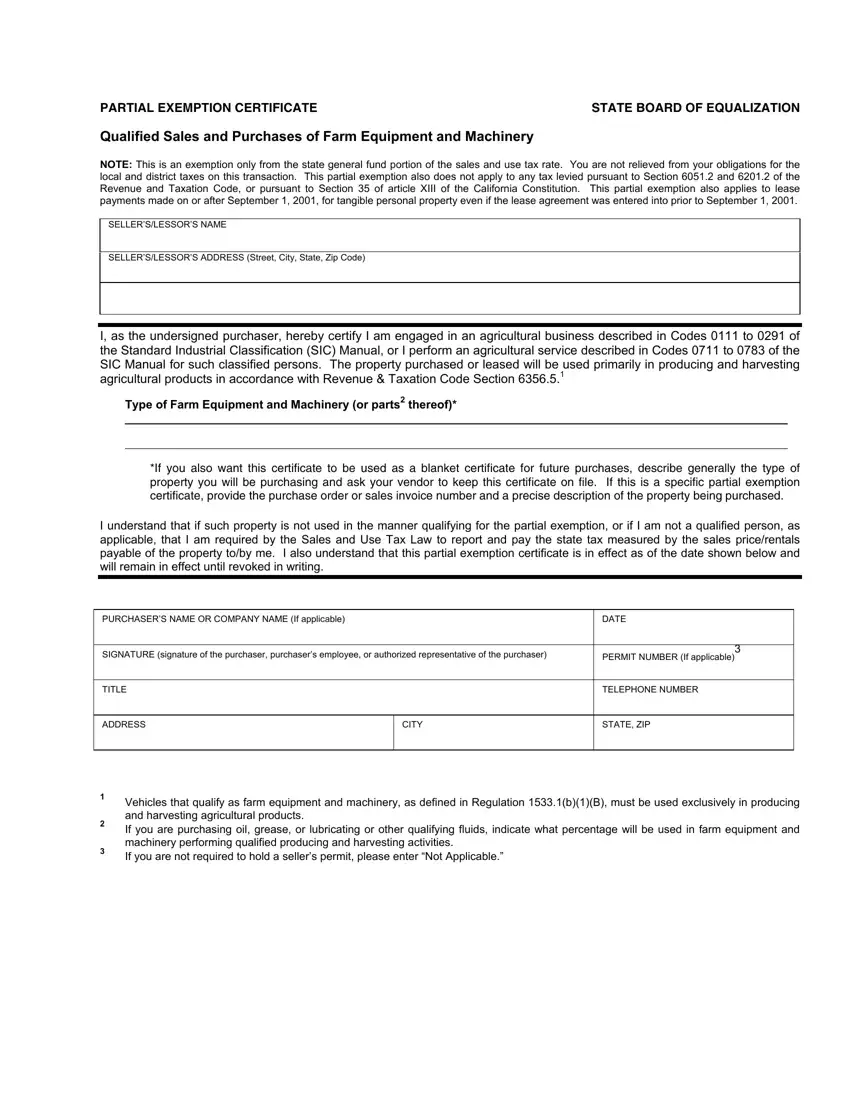

Partial Exemption Certificate Farm Fill Out Printable Pdf Forms Online

.jpg)